News

Why is it now thé time to invest in Spanish real estate?

That property prices have been on the rise since the banking crisis of 2008 is a fact.

They say, "Risk and return go hand in hand", but let's reformulate this to "Real estate and return go hand in hand".

To reinforce this statement, we will dive into the Spanish real estate statistics.

Source: www.tinsa.es

author: ImmoLNS Karen Sergeant

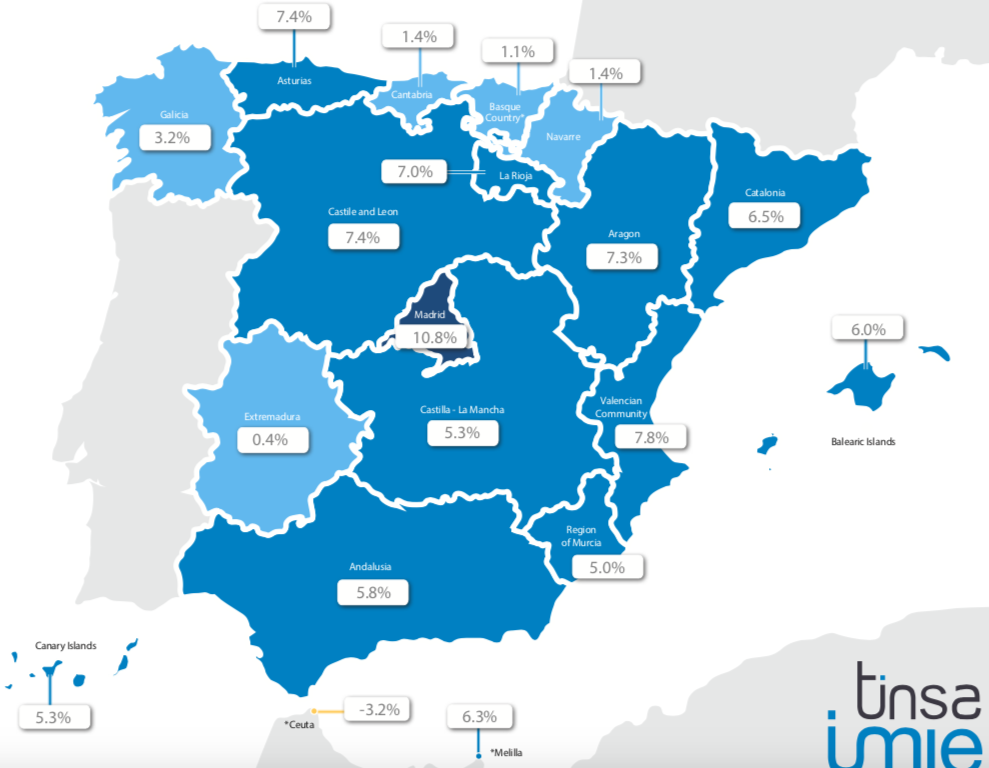

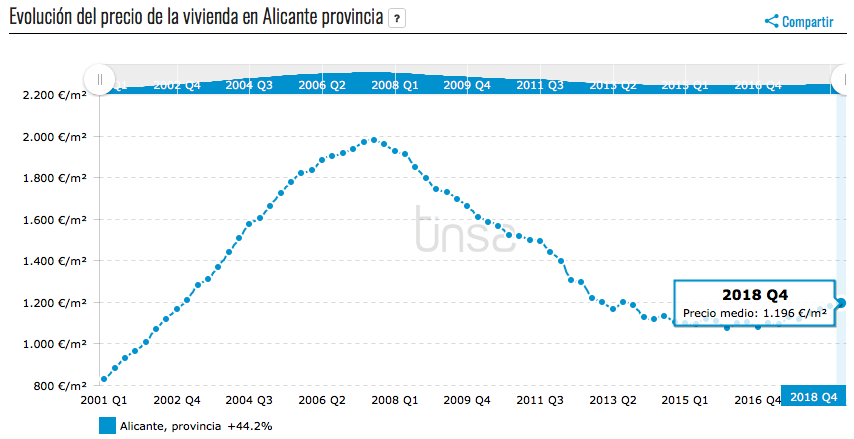

Spain is on the rise when we are talking about real estate prices, but we are not there yet. When we read the statistics of the national Spanish statistics office "Tinsa Group".

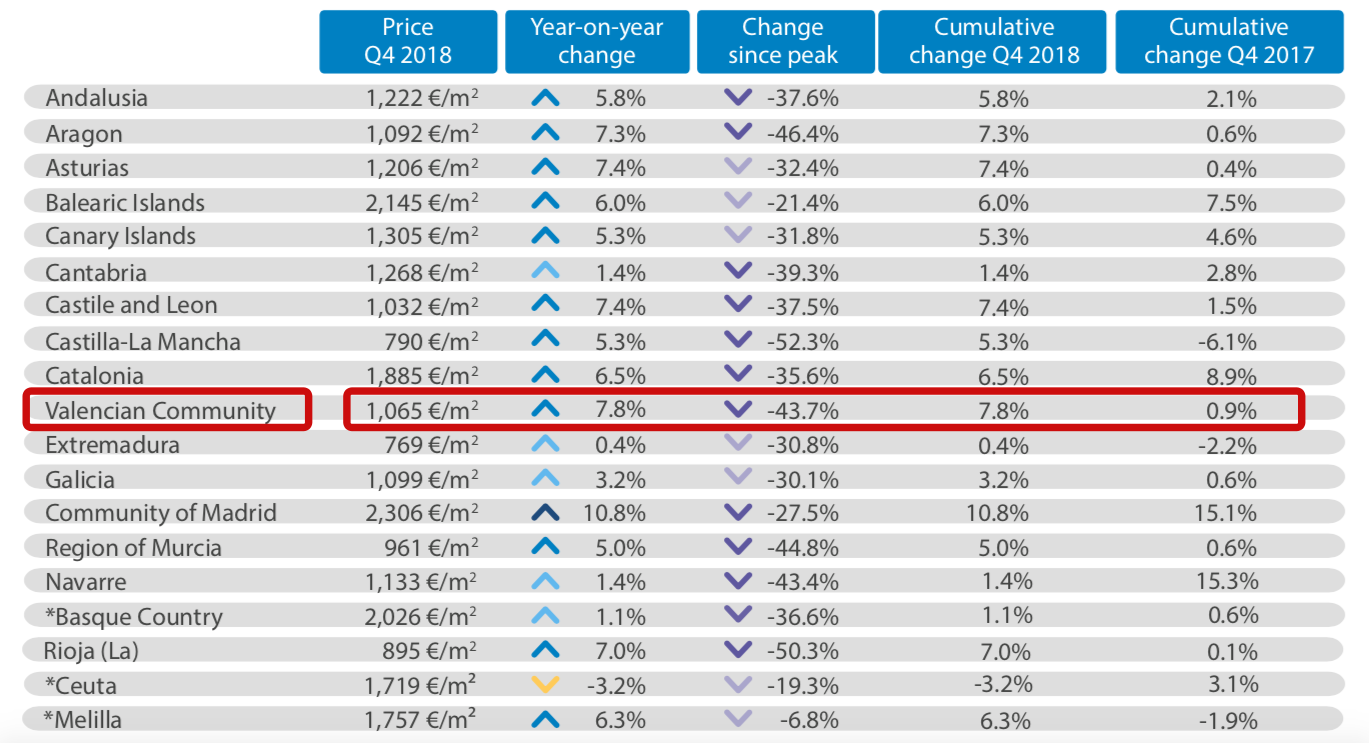

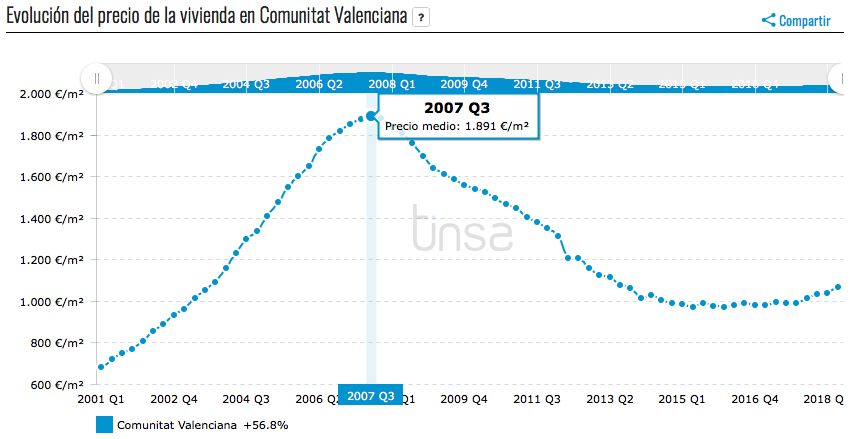

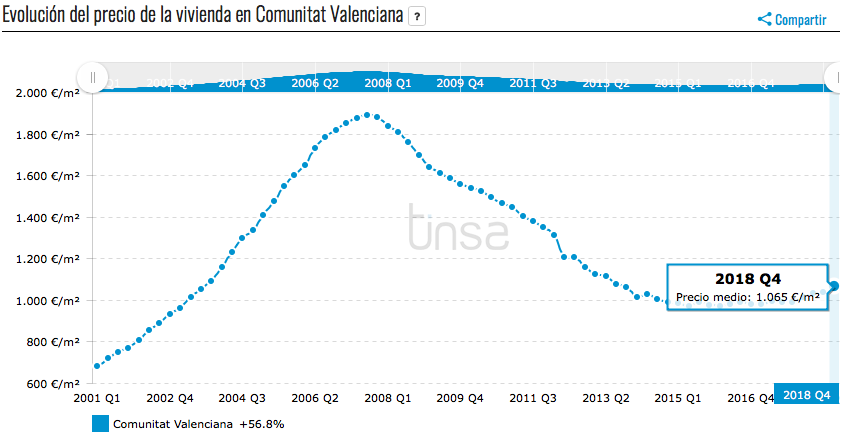

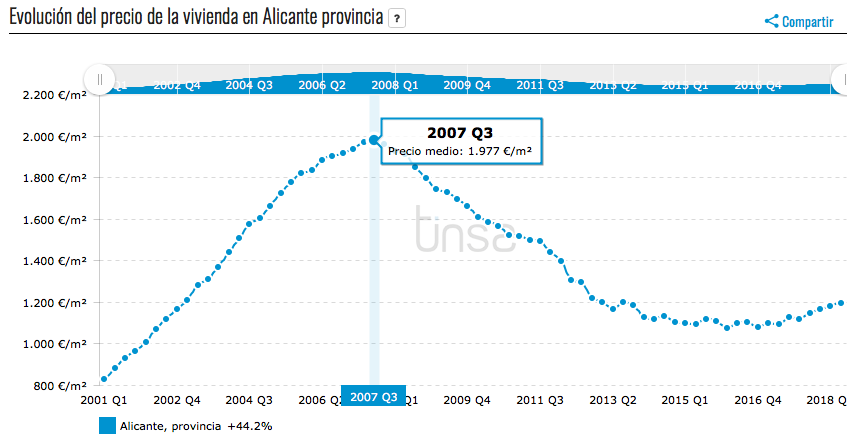

The communicated figures are based on the numbers of the Q4 reports from the year 2018 (Tinsa Group) with emphasis on the Costa Blanca North region. This region is part of the province of Alicante and belongs to the Valencia region.

1. Correlation of the real estate market and real estate prices.

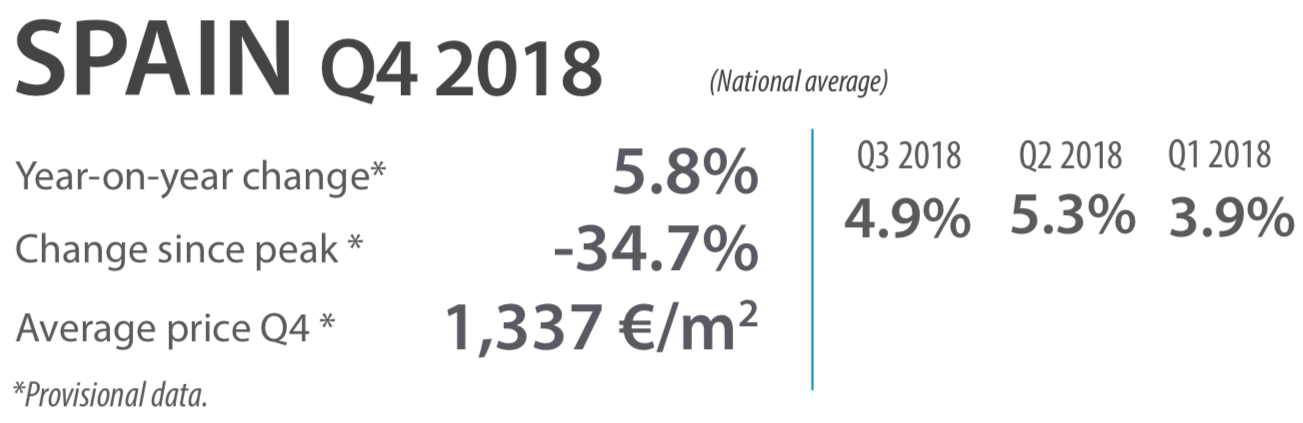

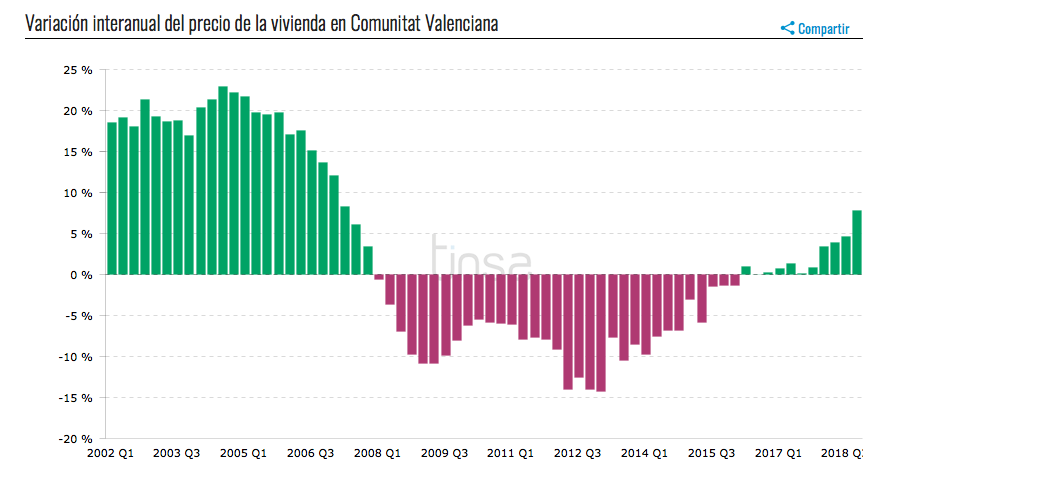

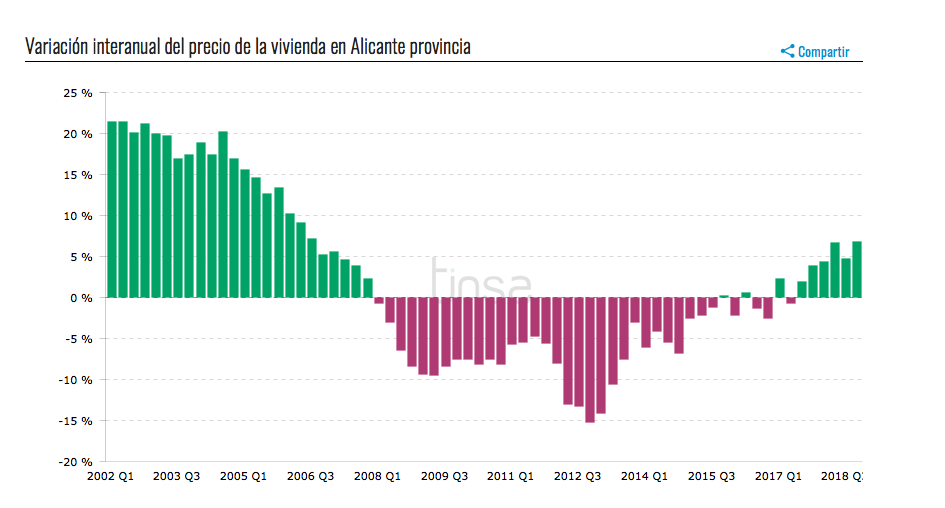

The available and collected data, of the Q4 report for 2018, show that a national price increase in the real estate market was observed of 5.8% or an increase of 1,337 €/m2 compared to the year 2017.

10 provincial capitals recorded a price increase compared to the previous year with > 10%, of which Valencia with 16.8% takes the lead. The average property prices have been on the rise since the third quarter of 2016 and are now 11.7% higher compared to the trough of the crisis in 2008. The Valencia region showed a rise in property prices of 7.8% compared to the year 2017. Only the Madrid region is doing better with a price increase of 10.8%.

If, for the Valencia region, we compare the prices per square meter, from the 4th quarter of 2018, to the peak, the 3th quarter of 2007 (just before the crisis), we can say that the current prices per square meter are still 56,32% lower.

Or in other words, in order to return to the same level of peak in 2007, a margin increase of 43.68% of current real estate prices would be required. Such a speed will no longer run, but this to show that there is indeed opportunity for value increase.

If we compare the prices per square meter for the province of Alicante, from the 4th quarter of 2018, to the peak, the 3th quarter of 2007 (just before the crisis), then we can say that the current prices per square meter are still 60,49% lower.

Or in other words, in order to return to the same level of peak in 2007, an margin of 39.51% of current real estate prices would be required. Such a speed will no longer run, but this to show that there is indeed opportunity for value increase.

2. Conclusion

If we compare the 2018 figures with 2017, we can deduce that the Spanish real estate prices for the Valencia region have risen by 7.8%. If we were to make comparisons with now and the price peak in Q3 of 2007, then we can conclude that buying a home at the Mediterranean is still 39.51% cheaper!

If one wants to invest in Spanish real estate, then it is still the ideal moment!

As a result of the crisis, real estate prices have been given a serious gnaw. But thanks to the current rise in real estate prices, you still have a very good chance of added value.

If we philosophize about a real estate bubble, it will probably no longer run like that! Real estate prices are rising but still very gradual and stable.

On the other hand, it is also not illogical that the building promoters have become more cautious as a result of the crisis. Thanks to the crisis, the chaff is separated from the wheat.

In addition, we can also say that, despite the banking crisis of 2008, the Spanish rental market has been able to maintain a good position over the years. Whether it is crisis or not, there are countless statistics that show that the average work person cuts down on all sorts of expenses in bad times, BUT that the annual holiday remains untouched!

In other words, if you make the right purchase, with the right guidance, you will not only be able to enjoy your investment yourself, but you will also be able to count on a good return.